IMStoned420

All American

15485 Posts

user info

edit post |

Did you really just compare cigarettes and labor? Really?  9/4/2012 1:25:23 AM 9/4/2012 1:25:23 AM

|

screentest

All American

1955 Posts

user info

edit post |

i read yesterday that the FED clandestinely gave out $16 trillion to corporations and foreign banks

http://theintelhub.com/2012/09/02/audit-of-the-federal-reserve-reveals-16-trillion-in-secret-bailouts/

and today i saw on the news that the US Debt is about to reach $16 trillion

could someone explain why this isn't some fucked up shit?  9/4/2012 2:35:50 AM 9/4/2012 2:35:50 AM

|

GeniuSxBoY

Suspended

16786 Posts

user info

edit post |

1) The Audit the Fed bill hasn't passed the Senate yet, so... I dont know where people think they audited the Fed. I've seem the article too, but again, they dont have access to audit them yet.

2) These numbers are more than likely whitewash

3) The ruining of our currency is pre-planned and was conceptualized in 1913.  9/4/2012 4:21:56 AM 9/4/2012 4:21:56 AM

|

d357r0y3r

Jimmies: Unrustled

8198 Posts

user info

edit post |

| Quote : | "Somalia doesn't have an income tax.

I've heard it's very nice this time of year." |

Income tax is the only thing preventing the United States from spiraling into warlord-operated chaos. Got it.

| Quote : | | "Did you really just compare cigarettes and labor? Really?" |

So you've got nothing? That's what I thought. 9/4/2012 9:14:38 AM 9/4/2012 9:14:38 AM

|

Dentaldamn

All American

9974 Posts

user info

edit post |

^

I give it 6 months  9/4/2012 10:04:50 AM 9/4/2012 10:04:50 AM

|

GeniuSxBoY

Suspended

16786 Posts

user info

edit post |

They're doing this on purpose. Ruining America.

9/9/2012 12:26:02 PM 9/9/2012 12:26:02 PM

|

moron

All American

33713 Posts

user info

edit post |

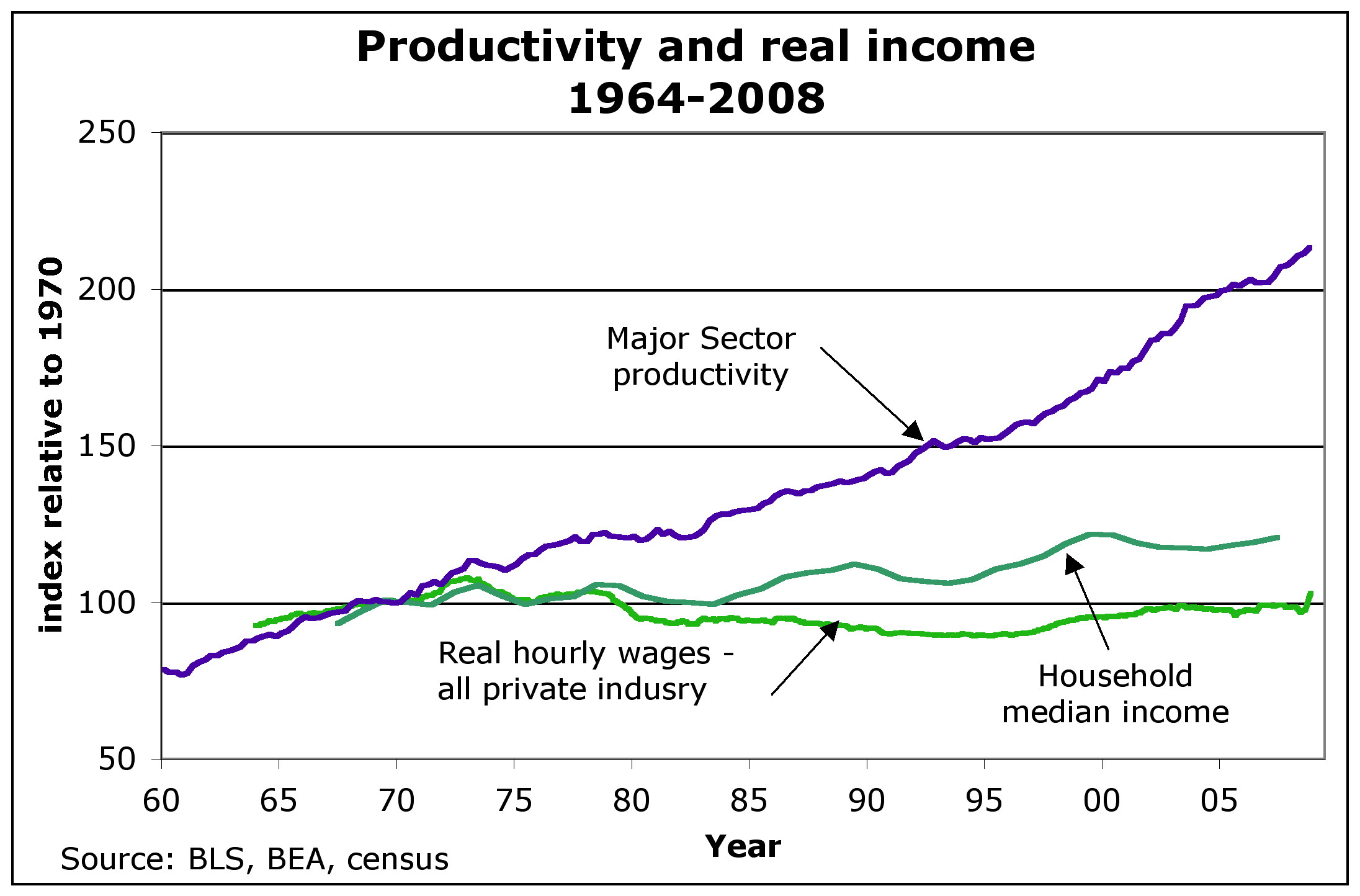

Taxes on workers aren't the problem, they're the ones clearly being screwed under the current system.

9/9/2012 12:33:59 PM 9/9/2012 12:33:59 PM

|

moron

All American

33713 Posts

user info

edit post |

[Edited on September 9, 2012 at 12:34 PM. Reason : ]  9/9/2012 12:33:59 PM 9/9/2012 12:33:59 PM

|

NyM410

J-E-T-S

50084 Posts

user info

edit post |

When Big Ben speaks, the market listens artificially inflates.  9/13/2012 3:13:38 PM 9/13/2012 3:13:38 PM

|

GeniuSxBoY

Suspended

16786 Posts

user info

edit post |

Dollar no longer primary oil currency as China begins to sell oil using Yuan

On Sept. 11, Pastor Lindsey Williams, former minister to the global oil companies during the building of the Alaskan pipeline, announced the most significant event to affect the U.S. dollar since its inception as a currency. For the first time since the 1970's, when Henry Kissenger forged a trade agreement with the Royal house of Saud to sell oil using only U.S. dollars, China announced its intention to bypass the dollar for global oil customers and began selling the commodity using their own currency.

http://www.examiner.com/article/dollar-no-longer-primary-oil-currency-as-china-begins-to-sell-oil-using-yuan  9/13/2012 4:21:27 PM 9/13/2012 4:21:27 PM

|

Str8Foolish

All American

4852 Posts

user info

edit post |

Because everybody is just itching to get their hands on yuans, totally a credible and respected currency on the world stage...  9/14/2012 11:59:37 AM 9/14/2012 11:59:37 AM

|

GeniuSxBoY

Suspended

16786 Posts

user info

edit post |

Is that the only conclusion you've taken out of that article?  9/14/2012 12:55:11 PM 9/14/2012 12:55:11 PM

|

Str8Foolish

All American

4852 Posts

user info

edit post |

I'm trying to find the place in the article where the dollar "is no longer the primary oil currency" as a result of China offering to sell it for the ridiculously manipulated yuan.

Bear in mind, China is #3 in oil imports, and #29 in exports by volume.

U.S. is number #1 and #9, respectively.

How the #29th exporter can unseat the "primary oil currency" by offering to sell their measly 500k bbl per day in yuans is beyond me.

Do these facts enter your head, GeniusXBoy? Or do you actually have a deathwish complex that makes you believe whatever the most-alarmist-possible assessment of any situation is?

[Edited on September 14, 2012 at 3:47 PM. Reason : .]  9/14/2012 3:41:21 PM 9/14/2012 3:41:21 PM

|

GeniuSxBoY

Suspended

16786 Posts

user info

edit post |

| Quote : | | "I'm trying to find the place in the article where the dollar "is no longer the primary oil currency" as a result of China offering to sell it for the ridiculously manipulated yuan. " |

Read the URL, bonehead. 9/14/2012 3:50:59 PM 9/14/2012 3:50:59 PM

|

Str8Foolish

All American

4852 Posts

user info

edit post |

Yes, I know it's in the title, that's why I'd like to know which part of the article justifies that being the title.  9/14/2012 4:41:44 PM 9/14/2012 4:41:44 PM

|

GeniuSxBoY

Suspended

16786 Posts

user info

edit post |

Fun Fact:

According to G. Edward Griffin, a history buff on the Federal Reserve and author of "Creature from Jekyll Island", the man on the monopoly board game is J.P. Morgan.

Remember: J.P. Morgan was one of the founders of The Federal Reserve. Also, our current money is color coded to match monopoly money. Symbolizing the Fed's plan.

Also another fun fact:

The character in Little Orphan Annie who played the rich "Daddy Warbucks" represented the real life European banking magnate "Paul Warburg" who was one of the richest men in the world at the time and who had the most knowledge about the European Banking System.  9/17/2012 12:11:27 AM 9/17/2012 12:11:27 AM

|

GeniuSxBoY

Suspended

16786 Posts

user info

edit post |

Ron Paul QE3 Predictions Are Already Proving to be Correct

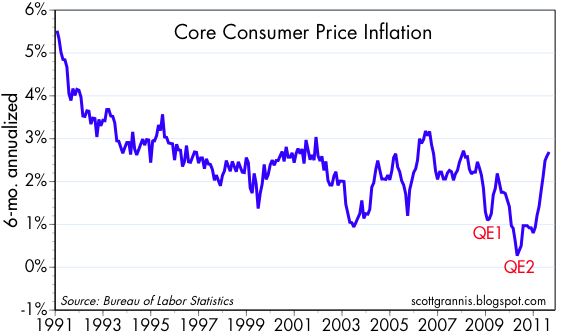

It has been nearly two weeks since Federal Reserve Chairman Ben Bernanke announced that the Fed would engage in another round of "quantitative easing" (QE3) by purchasing $40 billion in mortgage-backed securities (MGS) a month for the indefinite future and would be leaving interest rates near zero for the next few years.

Longtime Fed opponent and the staunch critic of Fed monetary policy Ron Paul issued a statement the next day regarding Bernanke's actions.

"No one is surprised by the Fed’s action today to inject even more money into the economy through additional asset purchases, " Paul said. "The Fed’s only solution for every problem is to print more money and provide more liquidity. Mr. Bernanke and Fed governors appear not to understand that our current economic malaise resulted directly because of the excessive credit the Fed already pumped into the system."

It hasn't even been a month yet since the Fed made their QE3 announcement, but Paul's Austrian-based analysis would suggest that it will only continue to make things worse. By further devaluing the dollar, buying up near-worthless debt, and keeping interest rates near zero, the Fed is sending terrible signals to the economy while simultaneously not allowing the debt and malinvestment to be liquidated. Without this necessary correction, true economic production and growth can not be achieved. Paul's recommendation of a "strong dollar and market interest rates" is once again being unheeded.

When QE3 was right around the corner, I argued in a PolicyMic article that "monetary injections" by the Fed tend to give the economy a short-term boost at the expense of steady, long-term economic growth (especially in election seasons when it is politically popular) and that Wall Street will do just fine since it is largely their paper assets and bad debts that will be propped up. But in the relatively short time since QE3 has been enacted, even the predictable short-term boost to the economy that defenders and proponents of monetary stimulus claim will result are already falling short.

The Fed's decision to buy up mortgage bonds has predictably lowered mortgage yields while inflation-protected bonds (TIP) have risen slowly. This means that QE3 is effectively making it harder for the U.S. government to borrow money — something that the U.S. government is doing a lot of simply to stay afloat, and the exact opposite of what Bernanke has intended to do. But the benefit of a slight drop in mortgage yields thanks to the Fed purchases of MGS is heavily outweighed by the increase in the yield of government bonds.

In other words, when the Fed buys bonds and the bonds actually go down in price, the bonds are being priced with the expectation of a wave of inflation in mind. Bernanke and QE3 may well be heading us down the road to stagflation. Judging by these factors alone, QE3 has failed even in its attempt to provide a quick boom and backstop.

Besides, even with the drop in mortgage yields, home prices are continuing to rise even though the market is signaling that they need to drastically fall and clear. This is another sign that the Fed and QE3 are preventing the corrections that are needed by artificially keeping the prices of houses too high.

So is Ron Paul right to be worried about the future of the economy after QE3?

If one cares about a sound economy backed by economic growth, production, savings, and interest rates that reflect all three, then he is absolutely right.

But in a way, QE3 is an absolute success. Not for you or I, of course, as we watch our dollars fall in value and a shrinking economic pie. But in the way that it will continue to mask the financial mess that the U.S. government is in — $11 trillion annual increases in the national debt, nearly 20% unemployment, and war after war — QE3 has done its job.

http://www.policymic.com/articles/15403/ron-paul-qe3-predictions-are-already-proving-to-be-correct  9/28/2012 3:45:24 AM 9/28/2012 3:45:24 AM

|

GeniuSxBoY

Suspended

16786 Posts

user info

edit post |

Step 1) PRINT $40 Billion a month to buy mortgages,

Step 2) BANKS give away houses to anyone with a down payment.

Step 3) FED buys up these mortgages instantaneously without question.

Step 4) Housing numbers BOOM

((this is where we are.))

Step 5) President is elected

Step 6) Homeowner default on their mortgage payments

Step 7) Collapse of the second housing bust

Step 8) The Federal Reserve now owns all the land.  10/15/2012 2:53:19 PM 10/15/2012 2:53:19 PM

|

Str8Foolish

All American

4852 Posts

user info

edit post |

Dude, get a blog, stop maintaining these one-man megathreads.  10/16/2012 10:46:52 AM 10/16/2012 10:46:52 AM

|

GeniuSxBoY

Suspended

16786 Posts

user info

edit post |

Worst Carry Trades Show Central Banks at Stimulus Limi

By Neal Armstrong and Allison Bennett - Oct 22, 2012 12:49 PM ET

The $4 trillion-a-day foreign- exchange market is losing confidence in central banks’ abilities to boost a struggling world economy.

http://www.bloomberg.com/news/2012-10-21/worst-carry-trades-show-central-banks-reaching-stimulus-limits.html  10/22/2012 4:12:03 PM 10/22/2012 4:12:03 PM

|

GeniuSxBoY

Suspended

16786 Posts

user info

edit post |

| Quote : | "IMF's epic plan to conjure away debt and dethrone bankers

So there is a magic wand after all. A revolutionary paper by the International Monetary Fund claims that one could eliminate the net public debt of the US at a stroke, and by implication do the same for Britain, Germany, Italy, or Japan.

One could slash private debt by 100pc of GDP, boost growth, stabilize prices, and dethrone bankers all at the same time. It could be done cleanly and painlessly, by legislative command, far more quickly than anybody imagined.

The conjuring trick is to replace our system of private bank-created money -- roughly 97pc of the money supply -- with state-created money. We return to the historical norm, before Charles II placed control of the money supply in private hands with the English Free Coinage Act of 1666.

Specifically, it means an assault on "fractional reserve banking". If lenders are forced to put up 100pc reserve backing for deposits, they lose the exorbitant privilege of creating money out of thin air.

The nation regains sovereign control over the money supply. There are no more banks runs, and fewer boom-bust credit cycles. Accounting legerdemain will do the rest. That at least is the argument.

Some readers may already have seen the IMF study, by Jaromir Benes and Michael Kumhof, which came out in August and has begun to acquire a cult following around the world. " |

http://www.telegraph.co.uk/finance/comment/9623863/IMFs-epic-plan-to-conjure-away-debt-and-dethrone-bankers.html 10/24/2012 6:39:22 PM 10/24/2012 6:39:22 PM

|

GeniuSxBoY

Suspended

16786 Posts

user info

edit post |

10/27/2012 9:20:41 PM 10/27/2012 9:20:41 PM

|

NyM410

J-E-T-S

50084 Posts

user info

edit post |

If nobody wants to talk about your bullshit can you please stop bumping the fucking thread? This entire thread is you spewing bullshit and people trolling you. Stop it!  10/28/2012 3:41:57 PM 10/28/2012 3:41:57 PM

|

GeniuSxBoY

Suspended

16786 Posts

user info

edit post |

If you don't want to talk about my interesting topic can you please stop clicking on my thread and posting? This entire thread is people like you spewing bullshit and trolling people like me. Stop it!  10/28/2012 3:46:49 PM 10/28/2012 3:46:49 PM

|

Str8Foolish

All American

4852 Posts

user info

edit post |

Seriously man, when you make 6 posts in a row over the course of a few weeks and the only response is "Stop posting" then you're really just clogging up the first page of the forum and are basically a spammer.

Also glad to see you learned exactly nothing from our conversation about the broken window fallacy, and for some reason think Bernanke has something to do with fiscal, and opposed to monetary, policy.

[Edited on October 29, 2012 at 10:34 AM. Reason : .]  10/29/2012 10:33:37 AM 10/29/2012 10:33:37 AM

|

Mr. Joshua

Swimfanfan

43948 Posts

user info

edit post |

10/29/2012 11:55:52 AM 10/29/2012 11:55:52 AM

|

GeniuSxBoY

Suspended

16786 Posts

user info

edit post |

| Quote : | | "Also glad to see you learned exactly nothing from our conversation about the broken window fallacy, and for some reason think Bernanke has something to do with fiscal, and opposed to monetary, policy." |

If you'd like to contribute to the thread, you are welcome to contribute. If you're going to argue, argue with someone else who you feel is a more worthy opponent. 10/31/2012 12:18:01 AM 10/31/2012 12:18:01 AM

|

GeniuSxBoY

Suspended

16786 Posts

user info

edit post |

| Quote : | "A former comptroller for a small town in Illinois pleaded guilty to embezzling $53 million from city accounts to feed a lavish lifestyle that included a nationally known horse-breeding operation.

Rita Crundwell, 59, pleaded guilty Wednesday to wire fraud in federal court for siphoning off taxpayer dollars to her secret bank accounts while comptroller of Dixon, Ill., the boyhood home of former President Ronald Reagan.

Crundwell spent most of the stolen cash on extravagant items such as a $2 million custom RV, a Florida vacation home and her most prized possession – a world-class horse breeding farm.

"If nothing else, what we have in this case is an object lesson in how not to manage public funds," Gary Shapiro, the acting U.S. Attorney for northern Illinois, said. "This is a crime that should never have been allowed to occur."

All of Crundwell's items are up for auction by the U.S. Marshals, including 400 horses. Only $7 million has been recovered so far.

"Since the day of her arrest, Rita has worked with the government to accomplish the sale of her assets, including her beloved horses -- all with the goal of helping to recoup the losses for the city of Dixon," Public Defender Paul Gaziano said.

The question many residents of Dixon are now asking is how did she get away with the scam for so long? Dixon Mayor James Burke said Crundwell was the only person who controlled the city's finances and funneled public money to her secret, private accounts.

http://gma.yahoo.com/ex-comptroller-pleads-guilty-stealing-53m-070145390--abc-news-topstories.html" |

This is what happens when you leave anyone alone and unchecked with a lot of money.

So why has the Federal Reserve never ever ever ever been audited? 11/15/2012 1:49:14 PM 11/15/2012 1:49:14 PM

|

Str8Foolish

All American

4852 Posts

user info

edit post |

| Quote : | | "So why has the Federal Reserve never ever ever ever been audited?" |

From 1913 to 1921 it was audited by the US Treasury Department.

In 1921 congress created the GAO specifically to audit the Fed.

It did so until 1933, when auditing authority was then performed by the 12 sub-banks until 1951.

From 1952 until 1978 it was audited by independent accounting firms.

In 1978 Congress passed the Federal Banking Agency Audit Act which restored the GAO's auditing authority, and since then the GAO has performed over 100 financial and performance audits of all three Fed bodies.

http://www.publiceye.org/conspire/flaherty/flaherty6.html

The reason they don't let the Fed get audited by a vote by Congress (As opposed to a more independent body) is because that would necessarily make the Fed subject to political whims, which reduces its credibility on the world market. The entire point of the Fed being mostly independent of Federal gov't is so that it's largely free of political pressure and can pursue long-term strategies that investors can have more confidence in.

[Edited on November 15, 2012 at 3:50 PM. Reason : .] 11/15/2012 3:48:59 PM 11/15/2012 3:48:59 PM

|

Str8Foolish

All American

4852 Posts

user info

edit post |

Fun Fact: The amount of crowing and hand-wringing somebody does about the Fed is inversely proportional to how much they actually know about it  11/15/2012 3:52:36 PM 11/15/2012 3:52:36 PM

|

GeniuSxBoY

Suspended

16786 Posts

user info

edit post |

An audit has levels of invasiveness . Let me know what they are and aren't allowed to audit and get back to me.  11/17/2012 6:15:30 PM 11/17/2012 6:15:30 PM

|

dtownral

Suspended

26632 Posts

user info

edit post |

move those goalposts  11/17/2012 6:35:50 PM 11/17/2012 6:35:50 PM

|

Str8Foolish

All American

4852 Posts

user info

edit post |

GeniusXBoy, maybe I'm crazy but the impression I get from your posts is that you thought the Fed had never been audited.

| Quote : | | "An audit has levels of invasiveness . Let me know what they are and aren't allowed to audit and get back to me." |

Why don't you let me know. You're the one who seems to think he's the Fed expert, despite having no fucking clue that they've been audited many times until reading my post just recently. 11/19/2012 11:11:05 AM 11/19/2012 11:11:05 AM

|

Str8Foolish

All American

4852 Posts

user info

edit post |

Consider the possibility, the simple possibility, that one, just one, out of the 60 or so conspiracy theories you believe in is not quite as sinister and conspiratorial as you think. That maybe, just maybe, all of the youtube videos with creepy music and videos of money-printing-machines was perhaps misleading you with some urban legends.

Read the rest of these, get acquainted:

http://www.publiceye.org/conspire/flaherty/Federal_Reserve.html

And from now on, when you read or watch something that parrots one of those myths (I know 1, 6, 7, and 9 are VERY popular), stop reading or watching it, because it's a bunk source spreading urban legends. Urban legends that, may I add, are in the same class as most NWO conspiracy theories, and are basically just secularized versions of old anti-Semitic global-ZOG propaganda spread by neo-Nazis in the old days.

[Edited on November 19, 2012 at 11:15 AM. Reason : .]  11/19/2012 11:12:08 AM 11/19/2012 11:12:08 AM

|

GeniuSxBoY

Suspended

16786 Posts

user info

edit post |

This is what you're suggesting:

The Federal Reserve is continually audited but was allowed to be corrupt anyway. Therefore the auditing services were corrupt or inept.

The only conclusion left is that the economy was crashed on purpose. Can you think of any other explanation? The top bankers are supposed to be the most fluent and brilliant minds in banking, yet they failed to manage the finances by compounding mistake after mistake after mistake, knowing full well where their decisions would take us.

I stand by my claim that the Federal Reserve has never been audited by and for the people.  11/19/2012 11:47:51 AM 11/19/2012 11:47:51 AM

|

Str8Foolish

All American

4852 Posts

user info

edit post |

| Quote : | | "The Federal Reserve is continually audited but was allowed to be corrupt anyway. Therefore the auditing services were corrupt or inept." |

The Federal Reserve isn't corrupt, except in the opinion of conspiracy theory-mongers like yourself. The world's investor class and foreign governments, on the other hand, who have more skin in the game than anyone else when it comes to the Fed's credibility, continually show their faith in it through their bond purchases.

But yeah, sure, this shiftless pizza boy on the internet knows something about the Fed that the global investor class and foreign governments don't. He cracked their global conspiracy to crash the world's economy by watching youtube videos linked to by dailypaul.com.

| Quote : | | "The only conclusion left is that the economy was crashed on purpose. Can you think of any other explanation? The top bankers are supposed to be the most fluent and brilliant minds in banking, yet they failed to manage the finances by compounding mistake after mistake after mistake, knowing full well where their decisions would take us." |

The economy crashed because a lot of brilliant people undertook transactions that were beneficial for them, individually, in the short term. The long term yielded a collective detriment. This really isn't hard to get: The bankers and the hedge fund managers and the financial instruments traders are in it for personal gain, not collective prosperity, and sometimes those two things are not the same thing.

| Quote : | | "I stand by my claim that the Federal Reserve has never been audited by and for the people." |

I stand by my claim that you don't know what you're talking about, and are operating on sentiments and vague suspicions engendered to you by secularized anti-Semitic propaganda that is more often than not based on strictly false urban legends.

[Edited on November 19, 2012 at 12:53 PM. Reason : .] 11/19/2012 12:51:27 PM 11/19/2012 12:51:27 PM

|

GeniuSxBoY

Suspended

16786 Posts

user info

edit post |

Seriously, there is a disconnect between reality and the information you're giving me. The United State's poor credit rating and the decision for quantitative easing and the decision to untie gold from the dollar are all irresponsible for a body that you claim is responsible.  11/19/2012 12:58:54 PM 11/19/2012 12:58:54 PM

|

dtownral

Suspended

26632 Posts

user info

edit post |

| Quote : | | "The Federal Reserve is continually audited but was allowed to be corrupt anyway. Therefore the auditing services were corrupt or inept." |

A+ circular logic

| Quote : | | "The only conclusion left is that the economy was crashed on purpose." |

Definitely not the only conclusion, in a list of conclusions "on purpose" would send you home on Family Feud

| Quote : | | "I stand by my claim that the Federal Reserve has never been audited by and for the people." |

Translation: I reject your facts and standby what I saw on YouTube 11/19/2012 1:03:49 PM 11/19/2012 1:03:49 PM

|

Str8Foolish

All American

4852 Posts

user info

edit post |

| Quote : | | "Seriously, there is a disconnect between reality and the information you're giving me." |

Nope.

| Quote : | | "The United State's credit rating " |

...is largely irrelevant, and its downgrading has had very little practical effect, and in fact Moody's themselves said specifically it was not because of Republican intransigence on raising revenue or the debt ceiling, not any behavior by the Fed.

Besides, by your own conspiratorial thinking, why on Earth would credit ratings agency NOT be in on the scheme too?

| Quote : | | "and the decision for quantitative easing " |

which has not led to gross hyperinflation, as basically all the idiots you listened to predicted for the first one, the second one, and now the third one. That's because their model is wrong, and doesn't actually capture the relationship between money supply and inflation (Hint, there are more variables than just money supply).

| Quote : | | "and the decision to untie gold from the dollar " |

Actually it was the best decision the Fed ever made, and the inflation-deflation swing cycle that caused once-a-decade financial crashes all throughout the 19th and early-20th centuries has as a result become more stable than ever, because now we can actually control our currency in response to the business cycle:

| Quote : | | "are all irresponsible for a body that you claim is responsible." |

I can see how you'd think that if you had no idea what you were talking about. 11/19/2012 1:04:32 PM 11/19/2012 1:04:32 PM

|

GeniuSxBoY

Suspended

16786 Posts

user info

edit post |

Do you think the destruction of the dollar is a genius decision? I'm trying to figure out what your goal is  11/19/2012 1:06:02 PM 11/19/2012 1:06:02 PM

|

Kris

All American

36908 Posts

user info

edit post |

So if we sent an auditor in the ONLY POSSIBLE two outcomes would be:

1. They find something and the FED is corrupt

2. They find nothing and the auditors and the FED are corrupt  11/19/2012 1:07:50 PM 11/19/2012 1:07:50 PM

|

dtownral

Suspended

26632 Posts

user info

edit post |

11/19/2012 1:08:10 PM 11/19/2012 1:08:10 PM

|

Str8Foolish

All American

4852 Posts

user info

edit post |

| Quote : | | "Do you think the destruction of the dollar is a genius decision?" |

Nope, and that's exactly what the Fed's not doing. This is what you don't get: A little inflation (2-4%) is actually very good for the economy, because it incentivizes investments. In a deflationary environment, business investment drops because it's more profitable to just hold onto your dollars than invest them. All the QE's have managed is to keep inflation just high enough that we don't enter another contraction due to deflation.

Two other things that are also probably news to you: Inflation also applies to wages, and deflation also applies to debts.

| Quote : | | " I'm trying to figure out what your goal is " |

A prosperous economy that isn't periodically crippled by the business cycle because we have no control over our currency value.

[Edited on November 19, 2012 at 1:14 PM. Reason : .] 11/19/2012 1:13:18 PM 11/19/2012 1:13:18 PM

|

GeniuSxBoY

Suspended

16786 Posts

user info

edit post |

| Quote : | "

So if we sent an auditor in the ONLY POSSIBLE two outcomes would be:

1. They find something and the FED is corrupt

2. They find nothing and the auditors and the FED are corrupt" |

GREAT QUESTION!

Answer it. (With the known variable that the system is FUBAR)

11/19/2012 1:14:25 PM 11/19/2012 1:14:25 PM

|

Str8Foolish

All American

4852 Posts

user info

edit post |

The answer is: GeniusXBoy has his conclusions set and he'll be damned if they can be changed by pesky facts.  11/19/2012 1:15:14 PM 11/19/2012 1:15:14 PM

|

GeniuSxBoY

Suspended

16786 Posts

user info

edit post |

No, you haven't given me reason to doubt my conclusion when the dollar has been losing value since the start of the FED and at this point people are talking about a FISCAL CLIFF.

Nothing to see here.  11/19/2012 1:17:29 PM 11/19/2012 1:17:29 PM

|

Str8Foolish

All American

4852 Posts

user info

edit post |

| Quote : | | "No, you haven't given me reason to doubt my conclusion when the dollar has been losing value since the start of the FED" |

Also since the creation of the Fed: The US economy has become the most powerful and prosperous on planet Earth, with one of the highest standards of livings, real wages have at worst stayed the same relative to inflation (That means wages are inflating too), and our past debts become increasingly easier to pay.

Again, some key facts you need to process: Inflation also effects wages, moderate inflation encourages investment, deflation does the opposite, and prior to the Fed we would regularly inflationary/deflationary swings between 10% and 20% every decade or two which would more often than not lead to nationwide financial crises with accompanying unemployment and growth swings.

| Quote : | | " and at this point people are talking about a FISCAL CLIFF." |

The "Fiscal Cliff" which is more of a hill, is a self-imposed speedbump at best, and at worst is a legislative headache that the media spins with its usual sensationalism to get poor saps like you who don't understand it to freak out.

[Edited on November 19, 2012 at 1:26 PM. Reason : .] 11/19/2012 1:24:13 PM 11/19/2012 1:24:13 PM

|

GeniuSxBoY

Suspended

16786 Posts

user info

edit post |

| Quote : | | "The US economy has become the most powerful and prosperous on planet Earth" |

If someone gave you a printing press, don't you think you could pull this off too? 11/19/2012 1:25:08 PM 11/19/2012 1:25:08 PM

|

Str8Foolish

All American

4852 Posts

user info

edit post |

By your own theory that print money = currency devalues, always, then no. You're contradicting yourself.

Either the printing press hurts prosperity or it helps it, you can't have it both ways.

[Edited on November 19, 2012 at 1:28 PM. Reason : .]  11/19/2012 1:27:26 PM 11/19/2012 1:27:26 PM

|

GeniuSxBoY

Suspended

16786 Posts

user info

edit post |

| Quote : | "By your own theory that print money = currency devalues, always, then no. You're contradicting yourself.

Either the printing press hurts prosperity or it helps it, you can't have it both ways." |

Yes, you can have it both ways.

The person that prints the money gets the strongest value out of the dollar he prints.

The person that saves his money gets the least value out of the dollar that was printed.

Printing money is a tax on saving accounts.

Inflation is inevitable when printing money unless an equal amount is taken out of circulation.  11/19/2012 1:31:45 PM 11/19/2012 1:31:45 PM

|